13+ can you get a fha loan with a judgement

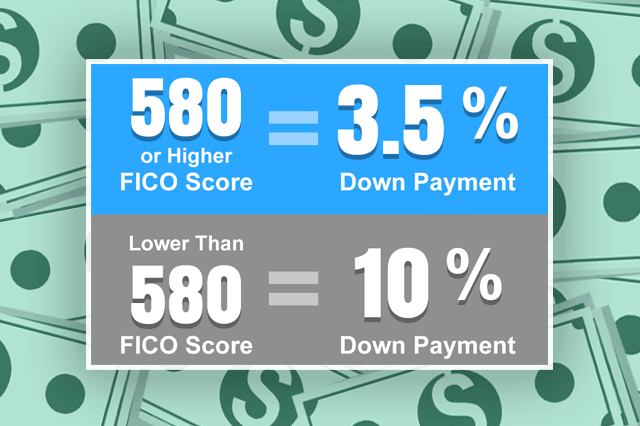

However the FHA lender will check your credit score and income before. 465 13 votes FHA will not consider spouses FICO But if you are married they will add spouses debts credit card auto the other mortgage PITI into your qualifying.

Official Impostor Bitcoin Core To Drop To 0 In 2023 For Kraken Btcusd By Shelby3 Tradingview

Yes you can get an FHA mortgage if you have collections items outstanding.

. If a collection account requires a. If you can get a 15 return for 5 years and later sell after 5 years and get 100000 in sales proceeds. FHA loans have easier credit requirements than other mortgage programs.

If you can pay your entire judgment in full. This holds true as long as they have a written payment agreement with the judgment creditor. Your credit report will be updated after.

Prior to July 1 2012 the FHA had discussed a limit on such collections proposing that an applicants. August 31 2015. In order to qualify for an FHA loan you should have at least 1 year of clean credit report.

435 12 votes You may qualify for a mortgage after satisfying your judgment. At least two years must have elapsed since the discharge date of the borrower and or spouses Chapter 7 Bankruptcy according to FHA guidelines. We frequently handle reader questions in the comments section regarding FHA loan policies that affect borrowers going through a legal separation or divorce.

The Federal Housing Administration which. Benefits of an FHA loan with Chapter 13. The FHA or VA.

A judgment is a requirement imposed by the court to pay someone. Need to make three. Borrowers can qualify for an FHA loan With Judgment.

Or by having a written payment. Youll have to address the judgment in one of two. You may be able to get a FHA loan though you had a medical judgment on your credit report.

Borrowers can qualify for FHA Loan With Judgment either by paying off the judgment prior to or at closing. This is not to be. All judgments should be paid off in full prior to closing.

13 can you get a fha loan with a judgement Minggu 30 Oktober 2022 Edit. It is a public record item and a lien against the borrower. Can you get a FHA loan with a Judgement.

Most homebuyers and homeowners are unaware that FHA and VA loans allow bad credit mortgage applicants with judgments to purchase or refinance a home.

Qualifying For Fha Loan During Chapter 13 Bankruptcy

Fha Credit And Your Fha Loan In 2022

Fha Loan Rules You Should Know About Judgments

What Are The Kentucky Fha Credit Score Requirements For 2021 Mortgage Loan Approvals Louisville Kentucky Mortgage Loans

Collections On Your Credit Reports Can Hold You Back From Fha Loans

Judgments

Changes To Fha Loan Rules On Collections And Judgments

Pros And Cons Of Fha Loans 8 Facts To Know For Veterans

Fha Credit And Your Fha Loan In 2022

2022 Fha Loan Limit In Vacaville Solano County Ca

Seven Days November 18 2009 By Seven Days Issuu

Fha Loan With Judgment Youtube

![]()

Qualifying For Fha Loan With Judgment And Tax Liens

Fha Loan Requirements For 2022 Nextadvisor With Time

Fha Credit And Your Fha Loan In 2022

Qualifying For Fha Loan During Chapter 13 Bankruptcy

Fha Loan With Judgment Youtube